First 100 people to use the code PATBET will get 20% off Fiverr services. Click here: http://bit.ly/2rs4npN

In a recent episode called The “Twenty Rules of Money” PBD mentioned how one of the rules was about doubling money. Due to popular demand, here is the standalone video on How to Double Your Money.

Before I actually get into talking about different ways of investments and how they double and what doubles this and what rate of return and all this other stuff, let me first talk to you about the biggest problem most people are facing when it comes down to trying to double their money. You know what it is? They don’t have enough money. That’s the problem.

Here’s a stat for you:

52% of Millennials ages 18 to 37 years old have less than $1,000 in savings.

Only sixteen and a half percent of Millennials have over $20,000 in savings. Only sixteen and a half. So what’s the problem? Savings. We need more savings. We need you to have more money in your pocket.

So why don’t people have more money in their pocket? Because of five different challenges:

- Income

- Expenses

- Taxes

- Investments

- Identity.

A lot of times people say, “Man, I want to have a very big income.” Well, you may have a big expense problem. Because what’s left is what matters to you, right? And then there’s taxes, but that’s a whole different discussion we’ll have.

So think about two examples here:

Example number one- We have somebody that makes $250,000 every year. That’s a quarter million dollar annual income. Many would say, “God, I wish made a quarter million dollar a year income.” Many people make a quarter million dollar a year income. But that same person spends $280,000 a year. That means he’s losing $30,000 per year. You know how many people I know like this? Hundreds of people that overspend what they make.

Example number two- Somebody makes $80,000 per year but they only spend $60,000. They keep $20,000 per year. The guy making $80,000 is saving more than the guy making a quarter million dollar a year income. So one has an income problem, because this guy would love to make a quarter million. The other guy has an expense problem; This guy wishes he only spent $60,000 per year.

So you may say, “Well, Pat. Okay. I want to make money.” Well, let’s talk about your income and expense problem first.

Let’s first start off with income.

What do you do to increase your income? If you have a job today and you’re watching this and if you don’t have something you do on the side, but you know every single talk show at night that you watch … Netflix, all this other stuff, you’re wasting your time. You don’t really care about have a lot of money. You’re just hoping to get lucky.

If you got a job and you’re broke, there’s no reason you should be coming home at night to watch TV. You should be selling something, creating something, learning a skill, having a side hustle, working overtime, getting another job on the side. You need to be selling something. And the highest paid money … the highest paid skill that you can learn about making more money is sales.

Number two, let’s talk about expenses.

You need to fire your consultant. If you’re a business owner running a business and you may have somebody doing a website for you, designing a logo for you, doing all this other stuff for you. Guess who they use?

They need to act like they’re the consultant but they go behind closed doors and they use company called Fiverr, which by the way, this video is sponsored by Fiverr. You just saw recently we teamed up with Fiverr. And everyone knows, you could go back to watch many videos in the past. I love Fiverr. I spent hundreds of thousands of dollars before I realized all these consultants could be found elsewhere.

What else can you do to minimize your expenses? Renegotiate all your contracts. Go through your monthly expense on what you’re spending on a monthly basis. Renegotiate your phone bill, renegotiate your cable bill. Renegotiate your cell phone bill. Renegotiate your internet bill. Renegotiate your dry cleaning rates. Go to your dry cleaners and say, “Man, I’ve been a customer of yours for 10 years, can you give me a discount?”

Renegotiate your tailor. Renegotiate every single thing. Every month I pull my director of finance aside and I say, “Who do we spend money on? It’s time to go renegotiate. We’ve been a customer with them for five years. How much money have we spent? Renegotiating time. Renegotiating time. Renegotiating time. Renegotiate all your contracts.

Live below your means. Listen, for a long time for myself, the reason why a lot of people don’t have money and savings to be able to double that money is because they overspend. Why do you go to Starbucks? Who cares about Starbucks? I even own Starbucks stock. I should be telling to go buy Starbucks but why are you going to Starbucks? Why five bucks? Go to Dunkin’ Donuts, a buck fifty, buck 75. Go to 7/11 seventy-five cents what is it ninety nine cents. How much is it? Dollar twenty something right, you go to 7/11. Stop going to these name places. Stop going to all these places you’re spending all this money on.

Live below your means. By the way, I had a quarter million dollars in the bank and I was driving a Ford Focus. I was worth nearly 10 million dollars and I was renting. I was renting a small place and I was worth 10 million. Nearly 10 million and nobody knew it. I’m renting and everybody would say, “I can’t believe you’re a millionaire and you would live in a place like this and you would rent it. Denver Post came out to me and they wrote an article saying, “This CEO and entrepreneur believes that real estate isn’t the American dream.” I said, “Absolutely it’s not.”

Because I was renting and everybody was criticizing me. Live below your means. Rent everything you can, for a long time. Rent everything you can. Use technology on minimizing payroll if you’re running a company. Have fewer employees pay higher. So don’t try to hire way, way, way too many employees. Have fewer employees, pay higher. You’ll keep them loyal so you don’t have to constantly going through new employees new employees new employees. Pay higher. Higher fewer. And then obviously, fire your consultants.

Next is taxes.

You know, sometimes … I mean, think about this … This quarter million dollar income guy or girl … if he or she lives in New York or LA versus Texas. This person’s paying an additional nine to 13 percent. Most likely 13% just for living in New York and for living in California. If it’s 10% on a quarter million that’s an additional $25,000 that went to the state that you wouldn’t be paying if you were living in the state of Texas, Nevada, I think Tennessee is one of them. Florida. There’s five or six states that you don’t pay any state taxes in.

So by the way, taxes is another issue you may be having. You need to sit down and figure out long term planning on what kind of money you want to really make. And how do you position yourself in the right place. I was in Florida last week. I was in Miami and I was in Orlando and I said, “The state of Florida’s governor must be the worst recruiter in the world”. Because if I was the governor of Florida, I would have more Fortune 500 headquarters there than any other state, including Texas, although Texas is tied with New York right now. I think they’re competing for number one spot. I’d have everybody there. The weather is amazing and you can pay no taxes in the state of Florida. Taxes is another issue that you may be facing.

Next one is now investments.

So let’s talk about investments here. All investments fall under these four different categories:

You have high-risk, low return.

You have low-risk, low return. (this is like your money market account, your savings, your cash)

You have low-risk, high return.

You have high-risk, high-return, (High-risk, high return could be penny stocks)

The bigger the company or the stock could be lower here. For instance let’s just say low-risk. Wal-Mart may be a lower risk. And I don’t know how to hide the returns. They may be here. High-risk, low-return there’s a lot of investments that you go out there and you buy companies saying, “Man, you know if … this company really takes off it could do this.” But there’s not really a high return on it.

So, here’s how to double your money:

This is the rule you gotta be thinking about. Rule of 72 and the rule of 105. It’s basic math. Rule of 72 is how long it takes for your money to double. So, what happens is, whatever interest you get per year, you divide it by 72. Meaning, if I want to get 72% every year on my money, that means it’s gonna take one year for my money to double.

If I make 36% return on my money, it’ll take my money two years to double. If I make 24%, three years. Eighteen percent, four years. Twelve percent, six years. Nine percent, eight years. Six percent, twelve years.

The same math applies on the 105 except this is how long it takes for your money to triple. So you would take … If I get 50%, that means, it would my money two years to triple. Same exact thing. You divide the 105 by the interest you’re getting on how long it would take your money to double or triple.

So you may say, “Pat, I would love to have 72%. Is there something like that out there? I would love to have nine percent. Is there something like that out there?” The decision you gotta make is you gotta answer two things. What’s your risk tolerance? And what’s your time horizon?

Let’s talk a little bit about going back to this on the investment side. A few things you gotta keep in mind about investments. People send me emails and they’ll say, “Do you think I need to invest in Uber? Do you think I need to invest in SnapChat? Do you think I need to invest in Facebook? Do you think I need to invest in this stock? What do you think about this ticker?” And they’ll send it to me, all the time, all the time. They just want me to go through their tickers. And I’m not doing that. I’m a series seven broker. Series six, 31, 26 [inaudible 00:10:58] securities all this other stuff. But I’m not doing that on [inaudible 00:11:01]. I am more concerned about you getting the right mindset than trying to pick the next stock.

I was at the flower shop the other day. And these successful Iranians who own this flower shop and they come to me and they say, “Look, everyone knows who you are and how successful is your business. Give us one tip on where we should invest.”

I said, “I don’t give those tips. My goal is to make you think right.

IF you think right you’ll learn how to double your money.”

If you can learn how to think right you’ll double your money. So let’s talk about the thoughts.

Number one. Specialize. Specialize. Specialize. Let me explain what I mean by specializing. I am at an art theater. She knows everything about art out there. And I’m talking about $3 million art and $2 million art and $6 million art and $600,000 art. She knew everything about it. You know how much she knew about stocks? This much. Guess what. Her specialty is art. I know people who specialize in real estate, commercial real estate. They know everything about commercial real estate. You know how much they know about residential? This much. Because their specialty is commercial real estate. Specialty is art. Specialize. Specialize.

Yes, you want to know a little bit about everything to be dangerous and you know the language, but go out there and specialize in one thing. Specialize in one thing.

Don’t buy emotional. Let me explain to you what I mean by don’t buy emotional. I hear a lot of people say, “Invest in what you buy.” Really? If invest in what I buy I’d invest into Slurpee. You know … Invest in what you buy. That’s like a kid. I go invest into ice cream. But you gotta invest in what you buy. I love Skittles. No. It’s not about invest in what you buy. This is not an emotional game. This is a logical game. Investments is not an emotional game. You gotta decide logically. You work your butt off. Did you just hear the stats I gave you?

Fifty-two percent of millennials have less than $1,000 in savings. Do you know hard you gotta work to make a quarter million dollars or make your millions or have $100,000 of investible cash? Do you really want to just throw it away? No. You don’t want to do that. So the point is, don’t buy emotionally, buy logically. Do your research. Find out. Does it make sense? Does it not make sense? Why should I? Why should I not? Do your part logically.

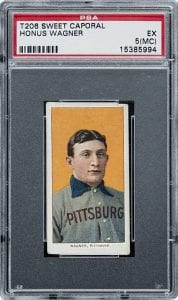

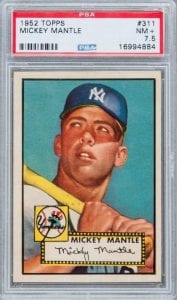

Invest what you know. Don’t invest in what you don’t know. Okay. I mean, for me, I was sitting out the other day and I was talking about baseball cards. I’m gonna talk to you a little bit different things about baseball cards. This one guy was saying, “Pat, I heard you talk about baseball cards. I think baseball cards are a waste of time.”

I said, “What do you know about baseball cards?” He said, “Nothing. I don’t need to know nothing.” Who in their right mind would go out there and buy a stupid piece of cardboard for $70,000. I said, “Who?” I said, “My gosh. You must not know nothing about baseball cards, which make sense. You’re not educated about it.” I said, “Do you know there’s a card out there called Honus Wagner T206.  A PSA 8 was bought in ’96 for $640,000.” I said, do you want to know what that card is worth today if you wanted to buy it?”

A PSA 8 was bought in ’96 for $640,000.” I said, do you want to know what that card is worth today if you wanted to buy it?”

He said, “What?”

Some would pay upwards of 10 or 15 million for that card. What if you bought that card in ’96 for 640? It’s worth 10 or 15 million dollars today. A PSA five was sold for $3.2 million just seven years ago. Some may say $20 million. A Mickey Mantle card, 1952 Topps for instance.  A PSA 9 Mickey Mantle 1952 Topps sold for $76,000. A PSA 8 and a half sold in November of 2016 by Heritage Auctions, lot of credibility, for $1.3 million. From $76,000 to $1.3 million. That PSA 9 card is worth two, three million dollars today.

A PSA 9 Mickey Mantle 1952 Topps sold for $76,000. A PSA 8 and a half sold in November of 2016 by Heritage Auctions, lot of credibility, for $1.3 million. From $76,000 to $1.3 million. That PSA 9 card is worth two, three million dollars today.

But the point is this. Invest in what you know. If you know nothing about baseball cards, don’t even listen to anything I just said. Nothing. Let it go through here. Don’t waste your time with it. If you do, study Michael Jordan. Study Ted Williams 1939 Play Ball. Study a Willie Mays rookie card, 1952 Topps. He’s 85, 86 years old. He’s still around but who knows what’s gonna happen. There’s a lot of value upside on that. Study what it is to go out there and get a Jerry West rookie card. Study what it is to go out there and get a 1952 … you know, I could go on. I don’t want to go there. The point is this. Invest in what you know when it comes down to investments.

Number four. Stock ownership is business ownership, just so you know that. Don’t look at it any smaller than that. If I want a stock of Microsoft I’m a business owner. I own a piece of it. I own a piece of Microsoft. That’s a very, very big deal, to have ownership. Buffet says this all the time. Stock ownership of a company means you’re a business owner. You own a piece of that company. Don’t take it lightly. It’s just about how many more pieces of that company can you own. This is how all of a sudden Buffet went from owning a few shares to a lot of shares, to the majority holder. Guess what. Now this is my company because I own the most shares. You can do that as well. It all starts with owning one share.

I remember the first time I bought a Nike I was so excited. I bought it for … $27 the first time I bought a Nike share. I was 20 years I got out of the Army I was like, “I own a part of Nike. I’m an owner, man.” I was so excited and proud of myself to buy the first Nike share.

Buy and hold. Very simple. People look at my body and they say, “Man, you must work out six, seven days a week.” All this other stuff. This is … I am six four, six five, 230 pounds because I’ve been working out three times to four times a week since I was 14 years old. That’s a long time that I’ve been working out. Investments are the same way. Buy and hold. So quickly when I talk about risk tolerance and time horizon. What is your time horizon?

I want to be a billionaire tomorrow or next year. Buy and hold. That person with patience is gonna beat you because you don’t have patience. You’re trying to become get rich quick, all this other stuff, so that kind of message appeals to you. A person that watches today’s message is not seeking to get rich quick. They want to think the right way.

Last but not least is cheap. This goes back to me talking to you about firing your consultants and hiring Fiverr.

The last one is identity.

We were in Orlando. This guy comes up to me name David. Good guy. David comes up to me and he says, “Hey, Pat. Let me ask you a question. So you talk identity a lot. How do I improve my identity and what do I do with identity?”

I said, “Listen, your identity pulls your income. If your identity is a half million dollar identity it’s mathematically impossible to be below half a million dollars for a very long time. Some of you guys are saying, “Pat, what the hell do you mean by that?” Will you work for $20,000 a year?

You won’t will you? Why?

Will you work for $40,000 a year, $60,000 a year, $100,000 a year, $200,000 a year, a million dollars a year? You’ve said yes to one of them. Whatever they’re paying you right now. Do you know why? Because that’s your identity. That’s your identity. You may not like to hear that, but it’s your identity. It’s impossible for half a million dollar identity to be accepting a $60,000 a year salary. It’s impossible. Unless the potential is a two, three, four, five million dollar a year income.

So, if you have $5,000 in savings, that may be a lot of money to you, and you have an identity issue. If you have $28,000 in savings, that may be a lot of money to you. If you have $48,000 in savings that might be a lot of money to you because you have an identity issue. You gotta fix this identity on how you think and what you think you deserve and all of a sudden you start pulling all of that in your life. I don’t know what it is. It’s just that’s how it works.

So now, having said all of this … By the way, identity there’s a video on how to recreate yourself. It’s a good video for you to watch. And if you haven’t watched a video on 20 rules of money I highly recommend you watching that video. But I’m not done, because I want to talk to you about a few different investments.

The types of investment options you have:

- Stocks . There’s different types of stocks that you can own.

- You can own the stock of a small cap; it’s a smaller company that’s going up. Mid cap, large cap. You can buy stocks in companies that have been around for a long time. They’re very established. You can buy stocks in newer companies. You can buy stocks by technologies. And buy the way, Warren Buffet’s philosophy isn’t to diversity. Warren Buffet’s investments were actually very concentrated to industries.

- It wasn’t about spreading it too much. He specialized in industry and he concentrated on owning companies in that industry. He’s a very big fan of insurance, by the way, Warren Buffet. So he concentrated, right. Stocks are the same exact way. First start studying what industry you want to concentrate on, then start picking your stocks. And slowly but surely start watching them one by one by one–if that’s the route you want to go to.

- Bonds are another one.

- Your returns on bonds are gonna be lower. Never gonna be higher unless you get junk bonds. Junk bonds are companies that are risky companies that are coming to you for a loan because bond is really an IOU. I come to you, I’m a company. I say, “We’re trying to raise 50 million dollars and the way we get it is by giving you bonds. You give me $100,000 and every year I give you six percent on that bond.” Which $100,000 on a 6 percent, $6,000 to you. Then ten years later the bond matures. Five years later the bond matures and you get your $100,000 back at a higher or lower 80,000 or 120,000 it depends on where you’re at.

- But that’s bonds. You’re not really gonna get the highest return on bonds. Depending on what age you are and your risk tolerance, bonds are a great investment. If you’re a boomer, higher again, you’re looking for lower return but more guarantees.

- Wine is something a lot of people look into.

- Investing into wine. I know a friend of mine that has a half a million dollars of wine collected for himself. And he knows it, but why does he do it and I don’t even touch it? Do you know how much I touch wine? This much. You know why? Because I don’t know nothing about the investment side of wine. I have a good glass of wine with my friends, but ask me to specialize, I have this much interest in wanting to specialize in wine. But he does. So, wine is a tricky business.

- It’s almost like some of my friends that’s trying to get into horse races and go to Kentucky Derby and start breeding horses and all this stuff. There is money in it but it’s risky. If you know the right trainers and the right people, great. But it’s not something I’d be encouraging you to start investing to right now. If you got 10 million dollars to throw away and you’re a billionaire watching this and it’s on your bucket list to say, “I had a horse that raced in the Kentucky Derby.” Go do it. I may do that one day. Honestly. Don’t be surprised if ten twenty years from now I have a horse in the Kentucky Derby just to say because it’s on my bucket list. I love the Derby. I love horses. I just don’t know if that’s how I’m gonna make my money.

- Currency.

- A lot of people say, “Pat, can you talk about currency?” If you want to specialize in it, there are people making money, but it’s a very small percentage of people that are making money in currency.

- Options. Very risky. Those who know it, they make money.

- Flipping real estate.

- I got friends that flip real estate and they do it very well. It generally is about … flipping real estate I would say the most important thing about flipping real estate is about the team you put together.

- Painting.

- Collectibles.

- Rental income. Real estate.

- Investor in businesses, which is what I prefer to do.

- That’s what I like. Listen.

I’m gonna tell you here right now, the fastest way for you to double your money–for me, at least … I am fully bought into this … and increase your income and minimize this and have taxes be on your side and increase your identity and investments, all this stuff. Look, I will debate anybody over and over and over again when they get up and they tell me real estate investments is the way to go. Look, go through Forbes 400. Go through Forbes 500, the richest people in the world. Go through them and see how many of them made their money off real estate. Now watch, before you debate it people will say, “Guy, you can’t say that. They all own real estate.”

How did they make their money? Entrepreneurship. Starting a business. Owning a piece of the business. Equity. Private equity. Investing. I want to own a piece of this. A startup. A risk with a business has the highest Xe factor, highest upside. That’s a business. That’s what you get into. Not on the other side of saying I’m gonna go out and sell real estate.

And then when these guys become worth ten million, twenty million, fifty million, a hundred million a half a billion, a billion dollars. Then you have to buy real estate. Then they go buy real estate. Of course then they start making some money on real estate and to have this rental income and all this other stuff. But I’m gonna tell you the number one way for you to double your money and have more money is to go out there and start a business.

You gotta go out there and be an entrepreneur. There’s nothing above it. I’m telling you right now. I’m gonna keep preaching this until God takes away my ability to speak to you or until I say I’m done producing videos on Valuetainment. One of those two is gonna happen. I could stop saying I’m gonna staying stop making videos 90 days from we finish this whole thing or somebody may say, “Pat, it’s time for you to leave.”

But I’m gonna make sure til the day I’m done I’m gonna be preaching entrepreneurship to you. So, above everything I just talked about here, fixing your income problems, learn how to sell, become an entrepreneur and then specialize in what fits with you and then start slowly but surely investing into that part of the business.

So if you haven’t subscribed to Valuetainment yet, click on the button to subscribe.

I’m sure there’s a lot of good questions. I want to hear your good questions that you have about today’s video.