Patrick Bet-David isn’t talking about having a few Benjamins in your pocket. This is about cash liquid net worth.

Most people will tell you to invest 90% of your cash into stocks, bonds, real estate so your money is off working for you. Pat has learned from his own experience and other’s that this plan doesn’t work for him. When Patrick was younger, he spent money he didn’t have, to try to double it. Most of the time it was in Las Vegas. After he hit rock bottom and was $49,000 in debt he switched to holding more cash.

Another example is when Pat rented his first big office space and got a great deal on the best office he had ever seen to that point. When he started inquiring to why he got such a great deal, he found out the owner put all of his 2 billion into real estate and lost almost all of it. These two examples drove home the point that being liquid is very important for growth. Especially when it comes to an economic downturn. When there is any slowdown in the market you don’t want to be tied up or to lose everything.

“When you are making a run for all the marbles, you got to trust some of the principles you have in place.” – PBD

Let’s look at some terminology in order to better understand why you want to stay liquid.

Common Market Terminology:

Correction-10% decline

Bear Market- 20% decline

Crash- 35% Decline (3.6 months)

Black Swan- Difficult to predict and extreme consequences

Recession- 6-month economic decline

Depression- A recession lasting 2 years & decline in GOP by 10%

Market Cycle

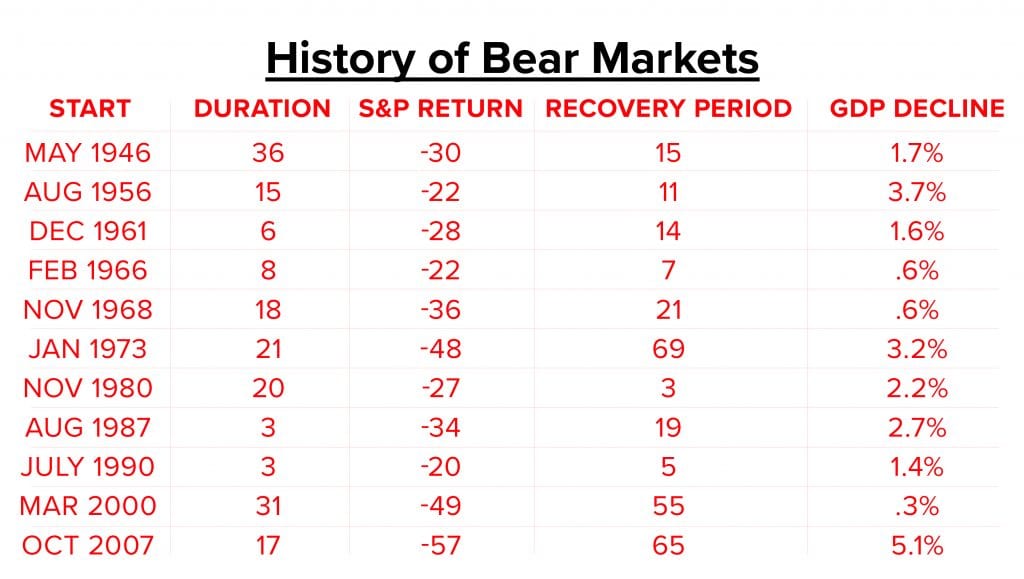

Since 1854 there have 33 recessions. 33 in 164 years which comes out to one every 5 years. Let’s take a look at the most recent bear markets:

We have not had a recession for the past nine years. What does that tell you? It could happen tomorrow, or it could come in the next three years. But it will come soon. So where can you put your money?

If you go long term in real estate, you could average about 4-6% return. In the stock market, long term you could be looking at 8-12%. These are all positive outlooks, but they won’t prepare you for the what if. You can be optimistic, but you also have to be prepared for what could happen.

Next, you need to consider risk and balance. How much are you willing to risk and how can you find a balance in that risk?

Risk

Everybody falls along this spectrum.

Afraid of Armageddon – These people can’t even be convinced to put a dime in the bank because total collapse is right around the corner.

Conservative – They believe in the conservative values like bonds and other long-term, tried and true avenues for their money.

Assertive – These people do research and learn. They don’t necessarily invest in everything they read about, but they are up on what is happening in the market.

Aggressive – They jump in with both feet into a lot of trends, some workout and some don’t.

Dumb – These people don’t understand that the market will not go up for forever. For some reason, they are surprised when there is any change in the market.

Finding a Balance

“What sells doesn’t always work and what works doesn’t always sell.” – PBD

When trying to figure out what strategy works for you, remember this quote. It has to make sense to you in all aspects. It can’t just sound good but not work, just like it can’t work well but doesn’t sound good.

Is Cash Still King?

The best example Patrick can show you how cash is still king is by going back to 2009. Ford was trading for less than a dollar. If you bought $10,000 worth of Ford, today you would have $110,000.

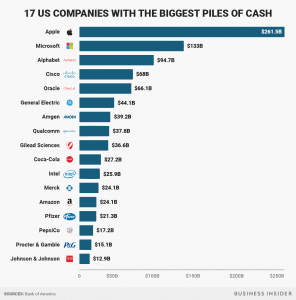

Now take a look at this chart of the companies with the biggest piles of cash on hand.

These guys are smart, right? So why are they stashing so much cash? They know a recession is coming soon and they are hoping opportunities are coming with that recession. The only way to seize those opportunities is by having cash on hand to capitalize on mistakes for forty cents on the dollar or better. That’s how they become worth a trillion dollars

So what does this mean to you? Look at all of this data and ask yourself when do you think the recession is going to take place and are you going to be prepared for it? These huge companies and Patrick Bet-David think very, very soon. Do what you have to in order to prepare.

Next Steps: Download the PDF and go over all the facts we went over. Don’t forget to tweet @patrickbetdavid.

Subscribe to Valuetainment

Visit the official Valuetainment Store for gear

About Valuetainment:

Founded in 2012 by Patrick Bet-David, our goal is to impact entrepreneurs around the world through value and entertainment. We are the #1 channel for entrepreneurs because of the best interviews, best how to videos, best case studies and because we defend capitalism and educate entrepreneurs.

To reach the Valuetainment team you can email: marketing@patrickbetdavid.com

Follow Patrick on social media: